CXO Partners’ Alejandro Mainetto discusses AI and the Future of Human Interaction.

Cybersecurity Webinar – Video Clips

CXO Partners recently held a 1-hour live webinar on Cybersecurity Trends in Energy.

Experts Dennis Gilbert, Jr., (Fmr. CISO of Duke Energy, Exelon); Betsy Soehren Jones (Critical Infrastructure Security Consortium); Alex Santos (CEO, Fortess Information Security); and Steve Swick (CXO Partners; fmr. Chief Security Officer) joined moderator John Allen of CXO Partners to discuss issues keeping CISOs up at night, including:

- The Impact of the CrowdStrike Outage

- How we can do Cyber Resiliency Better

- Legacy architecture concerns

- Security and the C-Suite

Here are 8 clips from the topics covered.

Case Study: AP Networks

AP Networks established aggressive revenue growth and new market entry objectives for their products and solutions.

Challenges

- Achieve new organic growth for multiple products and services

- Structure and scale the organization for rapid software revenue growth

- Optimize sales and business development efforts, targeting new customers and markets.

CXO Partners Launches New Supply Chain Practice; Dan Marous to Lead Group

CXO Partners, a professional services firm providing interim executives and transformative consulting services, is excited to announce the launch of its new Supply Chain Leadership and Services practice. This new group will be led by accomplished supply chain executive Dan Marous who will serve as Managing Partner.

“We’re thrilled to have a professional of Dan’s caliber running this new practice,” said Mike Casey, Managing Partner of CXO Partners. “His deep expertise in supply chain operations and demand generation will be invaluable in helping our clients transform their supply chains for success.”

Dan Marous has extensive supply chain operations and demand generation experience. He assists clients in the retail, furniture, apparel, and direct-to-consumer (DTC) industries as an interim Chief Supply Chain Officer and Chief Operating Officer.

The Supply Chain Leadership and Services practice will focus on three key areas:

Strategy Leadership and Development – This includes developing an overall supply chain strategy, omnichannel planning, and risk mitigation strategies, including near-shore alternatives. The firm will also provide interim CSCO services, CEO/Board advisory, fractional supply chain support, and coaching for operations leaders.

Growth – The firm helps clients meet requirements for organic growth, channel expansion, and scaling through acquisition, by creating strategies and plans for facility expansion, automation, co-manufacturing partnerships, due diligence, and post-acquisition integration.

New Capabilities and Transformation – The firm’s key solutions include process transformational initiatives like SIOP, Lean Six Sigma, and assortment and inventory strategies. CXO Partners will also provide supply chain systems implementation support for ERP, WMS, and DOM.

“My charge is to drive results and to lead change in supply chain performance by improving leadership, developing supply chain strategies, supporting demand growth, and building transformational capabilities via new processes, infrastructure expansion, and leveraging supply chain technology,” said Dan Marous. “CXO Partners is a perfect platform for me to help companies “unlock” supply chain capabilities that are critical to building corporate value, improving customer service, strengthening operations, and accelerating revenues and earnings.”

Dan Marous, CXO Partners, Managing Partner – Supply Chain Leadership & Services. More about Dan>>

The Hardest Job in Finance

Why PE Company CFOs Don’t Last

Nearly 80% Wash Out …and the Job Just Got Harder

One of the most difficult jobs in Finance is to be the CFO of a PE firm or a PE-backed company. According to a Big 4 firm’s survey, turnover of CFOs in PE and PE-backed companies is notoriously high, reaching 80% in less than five years; half of whom are gone within three years. The reasons range from tough, refined overseers to general breakdowns in fundamentals, such as timely reporting, to CFOs who don’t move with actionable, strategic insights, and operational Impact.

That’s the bad news. The worse news is the job just got harder due to shifts in PE activity.

Short Timelines, Big Expectations

By design, things move quickly in private equity. About a third of CFOs expect an exit for their company within 1-2 years, and a plurality for all concerned — investors and operators — is to complete a successful exit before 5 years.

Chief among the CFO’s goals is to drive up the valuation of a company at the exit. Industry valuations can fluctuate but expectations are generally for an EBITDA multiple above 10 with higher multiples for software and technology. Much of that burden falls on the leadership and implemented programs of the CFO.

Day to day, CFOs are expected to deliver the table stakes of good corporate stewardship via accurate numbers, timely financial reporting, solid internal controls, and compliance. On-point budgeting, smooth audit preparation, cash flow forecasting, and working capital management are all presumed to be standard.

The audience to whom this information is provided is a coterie of sophisticated general partners, limited partners, management committees, and portfolio companies who are all finance data-centric. It is difficult to present one version of the truth to audiences of varying agendas. Add to that the pace and pressure of the PE environment, which is the stuff of legend. Expectations are to deliver 110%. When that standard is met, work is ratcheted up to deliver 120%.

PE is Hard and Getting Harder

Those pressures are standard in normal business cycles. The increased difficulty comes as the number of private equity deals has slowed. If there are no deals, there are no returns for investors, the raison d’etre of private equity firms.

As a result, global private equity dry powder has rocketed to a record two and a half trillion dollars. The pile up of capital sitting on the sidelines and the scarcity of deals is creating pressure internally to put money to work.

A tougher lending climate combined with higher interest rates means leverage is not as easy to come by as it was a few years ago. In addition, global uncertainty about where interest rates are headed, the specter of inflation, wars, supply chain challenges, a wildcard US presidential election, and stubbornly wide distances between where buyers and sellers are on valuations, volatility reigns.

CFOs as Stewards, Strategists, or Prognosticators?

The multitask art of wringing out costs, driving margins, and operating leverage, while juggling working capital in an uncertain business climate, and now, providing an accounting perspective to the analysis of investment opportunities, some of which may be outside the normal parameters of historic investment objectives and criteria, is a new requirement of CFOs.

CFOs suffer from a myriad of competing priorities, some of which can be influenced by the CFOs training and background. Those who are more accounting infrastructure, process, controls and stewardship-oriented, perhaps due to their legacy as auditors tend to focus on financial and operational reporting. Those with a background a finance, investment banking, or FP&A background, may be more comfortable pursuing new opportunities, dealmaking, and strategy and less enamored with financial reporting, budgets, and compliance needs.

However the CFO is professionally oriented, they may retreat to more familiar tasks, despite good intentions to stretch into new areas.

Future Proofing

The finance chiefs are ultimately being asked to optimize the current business while developing the financial strategy to future proof organizations.

Ostensibly this would be achieved by closely overseeing existing assets, collecting and tracking KPIs, managing capital allocation initiatives, optimizing working capital, and then informing investors on the health and performance of the company/portfolio companies.

In addition, PE CFOs will contribute insights to investment models, the overall structure and intrinsic value of potential targets, optimize management and operational effectiveness post-investment all while delivering higher shareholder value with lower volatility.

All these elements, while also convincing PE firms to make the requisite investments in people, processes and systems, make this the toughest job in finance.

Mike Casey is the Managing Partner of CXO Partners, which provides interim CFOs for PE and PE-backed companies. He also serves as Managing Partner of TechCXO’s CFO practice and brings more than 30 years of financial and operational leadership with a proven track record of execution as a growth and turnaround CFO (more).

mike.casey@cxo.partners

How CISOs Can Leverage AI in Cybersecurity Plans

AI-powered security systems can ID and respond to threats at speeds that were once unimaginable. But there are risks.

Artificial intelligence is a game-changer in the world of cybersecurity. Its ability to analyze vast datasets, detect anomalies, and predict potential threats has revolutionized the way we protect our digital assets. AI-powered security systems can identify and respond to threats at speeds that were once unimaginable, making them a crucial component in our defense against cyberattacks.

However, with great power comes great responsibility. The deployment of AI in cybersecurity isn’t without its risks.

The challenge for CISOs is to walk the tightrope between mitigating AI risks while embracing innovation.

As a technology executive with over a decade of experience in the highly regulated fintech industry, I’ve witnessed firsthand the critical role that Chief Information Security Officers (CISOs) play in safeguarding sensitive data and ensuring the compliance of Fortune 10 companies.

CISOs can expect 70% of organizations to explore generative AI driven by the use of ChatGPT. Nearly all business leaders say their company is prioritizing at least one initiative related to AI systems in the near term, according to a recent PricewaterhouseCoopers’ report. Quoting Gartner analyst Frances Karamouzis, “Organizations will likely encounter a host of trust, risk, security, privacy, and ethical questions as they start to develop and deploy generative AI.”

The Promise and Perils of AI in Cybersecurity

First, CISOs need to be acutely aware of these risks in deploying AI:

- Complex Attack Vectors: AI can be exploited by cybercriminals to create more sophisticated and targeted attacks. An example of this is the recent data breach at TaskRabbit, where 3.75 million customers had their financial and personal data stolen. Analysts believe that an AI-enabled botnet was used, with the botnet slave machines executing a DDoS attack on TaskRabbit’s servers. This required a multifaceted mitigation approach, including strengthening TaskRabbit’s security infrastructure.

- Biased Data: Biased data from the internet and social media can lead to AI algorithms making prejudiced security decisions, resulting in false positives or negatives in threat detection. Consider the bias introduced by using data from the internet and social media which are limited in terms of coverage of the population. These shortcomings potentially limit the use of data from the internet for developing machine learning models that are applied to the general population and for specific groups. Organizations must rectify this situation by implementing strategies to address biases in their training data, incorporating more diverse and representative sources, and continually monitoring the system’s performance to ensure fair and accurate threat assessments.

- Inadequate Human Oversight: Overreliance on AI can lead to complacency and neglect in human oversight, allowing threats to slip through the cracks. CISOs should invest in the training and upskilling of security personnel to ensure that humans remain in control and have a deep understanding of how these AI systems operate.

- Adversarial Attacks: Cybercriminals can use AI to launch adversarial attacks against security systems, tricking them into misclassifying malicious activities. CISOs need to work closely with AI experts and ethical hackers to uncover and address weaknesses in their AI-powered cybersecurity solutions.

The CISO’s Balancing Act: Mitigating AI Risks While Embracing Innovation

The integration of AI into cybersecurity requires a delicate balancing act for CISOs. On one hand, they must mitigate the risks posed by AI, and on the other, they should embrace its innovative potential to drive business growth. Here’s how CISOs can navigate this challenging terrain:

- Assess and Mitigate Risks: The first step is to thoroughly assess the AI-powered cybersecurity solutions in place and identify potential vulnerabilities. CISOs should work closely with AI experts and white hat or ethical hackers to uncover and address weaknesses.

- Implement Ethical AI Practices: By ensuring that AI models are built on unbiased data and are regularly audited, CISOs can reduce the risk of biased AI making flawed security decisions.

- Promote Continuous Training: CISOs should invest in the training and upskilling of security personnel to better understand and manage AI-powered security systems. This ensures that humans remain in control and have a deep understanding of how these systems operate.

- Encourage Collaboration: CISOs should foster collaboration with AI experts and the wider business community. By working together, they can develop robust cybersecurity strategies that take full advantage of AI’s capabilities while minimizing risks.

- Stay Informed: The rapidly evolving nature of AI and cybersecurity demands constant vigilance. CISOs must stay informed about emerging threats and the latest advances in AI to adapt their strategies accordingly.

A New Era of Cybersecurity

AI is ushering in a new era for cybersecurity, presenting both unprecedented opportunities and intricate risks. CISOs, armed with their in-depth understanding of regulatory requirements and the unique needs of their organizations, are at the forefront of addressing these challenges. By meticulously assessing and mitigating AI risks, championing ethical AI practices, nurturing a culture of collaboration, and staying informed, CISOs can harness AI’s potential while fortifying their organizations against ever-advancing threats. The future of cybersecurity lies in the harmonious synergy of human expertise and artificial intelligence, and it’s the CISO’s responsibility to lead their organizations toward this promising horizon.

Gabriella Poczo

Operating Partner, Technology Strategy Services, Co-leader Financial Services

Gabriella Poczo is a highly accomplished technology executive with extensive experience providing product and technology vision, rapid product launches, and business/digital transformations as CIO and CTO.

Strategic Alignment or Discord?

Design a robust operating model to dramatically improve performance

A study published by Harvard Business Review stated what many under-fire executives intrinsically feel – 60-90% of strategic initiatives never fully launch. While there are many external conditions that obstruct business success (hyper-competition, tech disruption), it is often the business stimuli inside the org that most stifle strategic execution and impede turnarounds.

The primary reason businesses fail can be attributed to a single word: alignment

As a recovering strategist and experienced business operator, I maintain that the primary reason most businesses fail can be attributed to a single word – alignment. More than ever, it is the lack of alignment about a business’s goals, operating principles, and desired outcomes that inhibits success. The juxtaposition is ironic. On the one hand, these factors are internal to the org, and therefore should be the easiest for executives to shape and fix. On the other, they are often the primary and principal barriers to goal attainment.

See the free Strategy Evaluation Tool at the end of this article

Certainly, developing a strategic plan – including goals, priorities, timelines, and project sponsors – is an invaluable first step to generating alignment. However, it’s important to note that most strategies don’t detail how the work gets done. Consider a B2B software firm that seeks to improve its Customer Experience. Assigning a CSAT metric to a single functional leader is usually a recipe for disaster. After all, numerous departments interact with clients – Marketing sends them content, Sales sells the work, Operations fulfills the service, and Finance bills them – each of whom has a unique window into their people and organization. Without agreed-upon objectives, decision-making governance, and ways of working, the team will work laboriously – and fruitlessly – to reverse engineer a solution that satisfies all sides. The end of the story is a given: blame, resentment, and a solution that doesn’t fulfill the org’s goals.

Struggling with Execution? Design an Operating Model

Businesses with persistent execution challenges should consider designing an operating model that governs how different functions work with one another to achieve a company’s strategy. Designed purposefully, an operating model can unlock enormous new pockets of business value and dramatically improve productivity. Designed poorly – or worse, not designed at all – companies will likely remain misaligned as they continue to struggle to achieve even the most basic tasks and objectives.

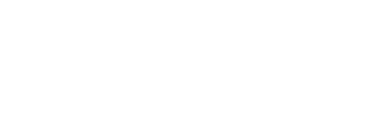

Designing a robust operating model for your business requires the purposeful alignment of the following core elements:

- Strategy & Goals: A company’s strategy governs where its time, investments, and resources should be placed to achieve a set of goals. The CEO – and senior leaders – must be more than simple advocates for the plan. They need to be vocal stewards of the strategy in public and unrelenting champions behind closed doors. Words matter here. So do details. A strategy that is not thorough, well-articulated, or well-understood is a leading cause of business discord.

- Decision Making & Governance: Each discrete function in a company must operate skillfully and collaboratively for a business’s strategy to succeed. Still,many departments work side by side without ever really working together. This is a silent killer for many organizations as they reach scale. Revaluating roles, decision-making, reporting, and accountabilities can ensure that leaders have appropriate and complimentary controls to streamline execution and run the business.

- Ways of Working and Processes: Executing a new strategy usually requires material (and often uncomfortable) changes to the way a company operates. For example, improving a company’s return policy might require new processes and cadences between organizations that don’t typically collaborate closely (e.g., Supply Chain and Support). Using a ‘systems thinking’ approach can help unite different, often competing, functions based on the value they generate so everyone in the org knows their role in the process – and marches to the same beat.

- People and Skills: Many failed strategies can be attributed to leaders spending too much time salivating over new potential markets and products, and far less time on the internal competencies required to execute effectively. Cultivating your people capability should be prioritized based on the strategy being formulated – whether professionalizing a sales org to sell larger deals or optimizing support to better delight customers.

- Data and Technology – Wherever you are on your digital journey, it is critical that orgs align their technology roadmap to their business’ strategy and goals. At the same time, all orgs should consider designing a robust operating model that encourages continuous business disruption and reinvention based on technological innovations.

- Culture and Norms – Every business is a unicorn. Companies should be mindful to incorporate their unique ethos and character directly into their ways of working. At the same time, don’t be afraid to challenge ‘sacred cows’ that no longer have the desired impact they once did. Above all, put your people first when planning your operating model to ensure employees feel respected, appreciated, and protected.

An operating model is the central nervous system of a business. It governs the way organizations operate collectively to achieve a set of goals and fulfill its business strategy. Many companies, large and small, who struggle with business execution have likely grown out of their previous operating model and need to reimagine the way they ‘perform work’ to succeed.

Take our short 10-question diagnostic survey if you’d like to take the first step to designing your own operating model to help you achieve your business goals.

Create your own user feedback surveySeven Best Practices that will turn your VOC into a Money Machine

In today’s challenging business climate, companies are facing longer sales cycles and the looming shadow of a potential recession, and it’s more important than ever to stay ahead of the competition and find ways to differentiate ourselves in the marketplace. To achieve this, businesses need to listen to their customers and incorporate their feedback into product development processes. This process is known as the voice of the customer (VOC). In this article, we will discuss the seven best practices that businesses can adopt to drive revenue growth through effective VOC to develop innovative products.

VOC is not a new concept; however, it has been evolving throughout the years. Four important trends have emerged in the evolution of VOC: a shift towards customer outcome focused research, increased interaction during interviews, improvements in identifying and addressing misleading data, and a more effective approach to analyzing data and turning it into useful information for the R&D department. These trends enable companies to create truly differentiated, innovative, and higher-value new products that meet the needs of their customers more closely and more effectively than before.

Also, as part of the product’s Go to Market plan, that some VOC information can be used to create a targeted marketing campaign that resonates with customers, increasing the likelihood of a successful product launch.

Before digging into the best process to conduct a truly effective Voice of The Customer process, let’s define how high value Innovation is achieved.

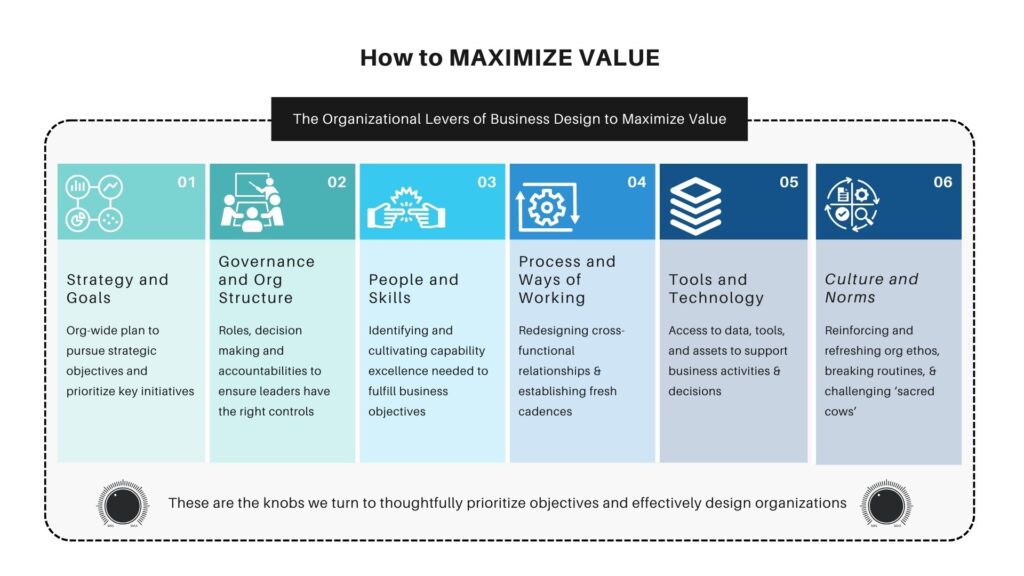

Successful (innovative) new products share three key characteristics:

- They satisfy an underserved outcome need for the customer, meeting a need that is currently unaddressed in the market.

- They offer differentiated functionality and user experience that surpasses that of existing products, including those from the competition.

- They offer a compelling value proposition, meaning that the combination of benefits and price makes the product an irresistible offer for customers.

Measurable innovation requires a holistic approach that encompasses these three key elements. Any gaps can impede innovation and limit a company’s ability to meet its customers’ evolving needs. By aligning the VOC program with the three key elements of innovation, companies can unlock the full potential of the VOC and use it to drive measurable innovation to gain a competitive advantage, stand out in the marketplace, and drive business growth faster.

Here are the 7 Best Practices that will turn your VOC into a Money Machine

- Define the objective of VOC from the Customer’s shoes: The first step in leveraging VOC to drive revenue growth is to define the objective of the process. This involves setting clear goals and objectives for the VOC program, such as understanding customer needs, identifying gaps in current product offerings, and improving customer experience and satisfaction. A well-defined VOC objective helps businesses to focus their efforts on areas that will have the most impact on revenue growth. Remember that the customer is not an expert in your product but in their products, so the VOC needs to unearth the barriers and obstacles that prevent your customers from achieving their Outcomes, and how your new product will help them get there. By understanding the customer’s desired outcomes, businesses can develop a product or solution that is focused on helping the customer achieve those outcomes, rather than simply addressing their stated needs or preferences. Your customer will not design the product for you, rather, it is up to the business and its engineering team to use the VOC insights to develop the right solution.

- Identify the right target audience: The next step in the VOC process is to identify the target audience. This involves understanding who the customers are, what they need, and how they use the product.

By identifying the right target audience, businesses can tailor their product development efforts to meet the specific needs of their customers, resulting in higher customer satisfaction and increased revenue growth. Now, it is a well-established fact that no product or service can satisfy all industries and market segments. Every market segment has its own unique needs and requirements, and therefore, it is important for companies to choose the right segment and develop a new product that caters specifically to the needs of that segment.

If a company tries to target all segments with the same product, it will likely face challenges in meeting the diverse requirements of each segment. Such a strategy could also result in a diluted product that fails to effectively address the unique needs of any specific segment, ultimately leading to decreased customer satisfaction and lost market share. Choosing the target market is a strategic decision that will depend on the business strategic plan and growth plans.

Focusing on a narrower and more defined market often results in a more effective product and a better chance of success. Even better, targeting specific personas, companies can tailor their marketing efforts to communicate the value proposition of their product more effectively to the target audience.

More sophisticated VOC programs even define the “title to sell to”. This extra effort can bring an additional opportunity for companies to better understand the decision-making process of their target customers. By identifying the specific titles or positions within a company that are responsible for purchasing decisions, companies can not only tailor their product development efforts, but also their marketing strategies to effectively communicate the value proposition of their product to these decision-makers. This can help to ensure that the product meets the specific needs and requirements of the target market segment and increase the chances of a successful product launch. Furthermore, by understanding the decision-making process, companies can develop effective sales strategies that focus on the key decision-makers and increase the chances of closing the sale.

Once the target market and persona/title have been clearly defined, then the right people must be contacted and invited to the program. Typically, the best candidates are those customers that have been vocal in asking for product improvements, and, if possible, non-customers that typically buy from competition. Those users that “love” your products may have less requests for new functionality or improvements. Nobody likes to hear a customer pointing out what they do not like about your product, but these are the best sources of useful insights for you VOC.

- Choose the Best Methodology: When it comes to conducting VOC research, there are several methodologies available, including surveys, focus groups, observations, and interviews. Each methodology has its own strengths and weaknesses, and businesses need to choose the right methodology based on their objective, target audience, and budget. However, the most effective approach is the one that allows for in-depth insights into the customer’s desired outcomes, rather than simply their stated needs or preferences.

Face-to-face interviews are often the best methodology as they allow for more in-depth and open-ended conversations. In a face-to-face interview, the interviewer can ask follow-up questions and probe deeper into the customer’s desired outcomes, which can lead to more valuable insights. Additionally, face-to-face interviews can help build rapport and establish a personal connection with the customer, which can lead to greater trust and a willingness to share more information.

However, face-to-face interviews can be more expensive and time-consuming than other VOC methodologies, such as surveys, especially if they plan to interview anywhere from to 50 to 200 customers, for example. If budget and time constraints are a concern, businesses may need to consider alternative methodologies such as virtual interviews, or a hybrid program where the most important customers are interviewed, and the others are asked to complete an online survey. Online surveys can be a cost-effective way to gather large amounts of data quickly, but they may not provide the same level of depth and richness in the insights obtained, so if the project is critical to the success of the business, the ROI from face-to-face interview will be significantly higher.

Regardless of the methodology, using lean processes will bring in any scenario, increased efficiency, reduced waste, and improved outcomes. Lean processes focus on identifying and eliminating activities that do not add value to the customer, thereby streamlining the workflow and reducing costs. By adopting lean principles, businesses can optimize their VOC research by focusing on the most critical customer needs and desired outcomes, while eliminating activities, questions, analysis, debates, and considerations that increase costs, the time spent and the need for resources, but that do not contribute to the final product design and success.

- Gather and Organize the Right Team: Successful VOC programs involve stakeholders from across the organization, including product development teams, sales teams, and customer service teams. By involving stakeholders, businesses can ensure that everyone is aligned to the objectives of the VOC program and that the insights gathered are used to drive revenue growth. Building the right team with specific roles, skillsets, and expertise is crucial for organizing and conducting an effective VOC effort. A well-organized team can ensure that all angles are well covered, and that the insights obtained are comprehensive, accurate, and actionable by the respective organizations.

The first step in assembling a VOC team is to define the roles and responsibilities of each team member. Ideally, the team should consist of members with different skill sets and expertise to cover all aspects of the VOC process. This includes individuals with marketing, product development / product management experience, engineering knowledge, in addition to the salespeople. Each member should have a clear understanding of their role and how their contributions fit into the overall VOC process. This does not imply that every one of these individuals will conduct interviews, but that they will contribute in different capacities to the planning, questionnaire/survey creation, scheduling, interviews, data gathering and analysis, etc.

Once the team has been assembled, it is essential to establish clear communication channels and protocols. This includes defining the objectives of the VOC program, creating a timeline, and setting clear expectations for each team member. Regular team meetings can help ensure that everyone is on the same page and that progress is being made towards the objectives.

Another important aspect of an effective VOC team is ensuring that team members have the necessary resources and tools to conduct their work. This may include access to market research tools, customer feedback management systems, as well as the CRM.

In some instances, it may be beneficial to bring in third-party resources to help execute a VOC program. This can help to eliminate internal bias and provide an objective perspective on the data gathered. For example, if the organization has a history of developing products based on assumptions rather than customer feedback, an external consultant with expertise in VOC research could provide valuable insights and guidance. Additionally, if the organization lacks the necessary resources or expertise to conduct a thorough VOC program in-house, a third-party research firm could be hired to help with the execution. In general, although not always necessary, bringing in third-party resources should be considered when the internal team lacks the necessary expertise, is too close to the subject matter, or when an objective perspective is needed to ensure the success of the VOC program.

- Collect & analyze data/Prioritize feedback: Once the data has been collected, businesses need to “make sense” of the wealth of feedback they have received. The objective of the analysis is to identify patterns, trends, and areas for improvement. Not all customer feedback is created equal, and businesses need to prioritize feedback based on its impact on revenue growth. Feedback that is critical to the success of the product should be given priority over feedback that is less important. For example, if the feedback indicates that there is a critical flaw in the product that prevents customers from using it, this should be given priority over feedback that relates to minor issues or nice-to-have features.

In addition to prioritizing feedback, businesses also need to consider the context in which the feedback was given. For example, feedback provided in a support ticket may be more urgent than feedback provided in an interview. Similarly, feedback provided by a long-time customer may carry more weight than feedback provided by a new customer.

It is also important to note that customer feedback is not always explicit. Customers may not always be able to articulate their needs or pain points, and it may be necessary to read between the lines to identify underlying issues. For example, if a customer complains about specific issues preventing them from accomplishing their outcomes, the analysis needs to lock on the job to be done more than on the actual product technical specs.

Overall, the collection and analysis of customer feedback through the VOC process is a critical step in the product development process. It provides valuable insights into customer needs, preferences, and pain points, which can guide product development efforts. By prioritizing feedback based on its impact on revenue growth, businesses can ensure that they are focusing their efforts on areas that will have the most significant impact on the success of their products or services. Missing key comments or feedback during this process may lead to an unsuccessful product.

- Clarify/Rephrase: After conducting Voice of the Customer (VOC) interviews, it is important to analyze the data carefully to understand the customer’s needs, preferences, and pain points. However, even after careful analysis, there may be additional questions or areas of confusion that arise. In such cases, it is essential to clarify and rephrase the questions to the customers to ensure that the data collected is accurate and reliable.

Clarification and rephrasing of questions are essential for two reasons. Firstly, they help to ensure that the data collected is accurate and reflects the customers’ true needs and preferences. During the interviews, customers may use different terminology or language that can be interpreted in different ways while taking quick notes on the fly. Without clarification, it can be challenging to determine the precise meaning of what the customer is saying. Rephrasing the question in different ways or asking follow-up questions can help to provide a clearer understanding of the customer’s needs. Secondly, clarification and rephrasing of questions can help to build trust with customers. When customers are asked to provide their feedback, they may be hesitant or unsure about what they should say. Clarification and rephrasing can help to show that the interviewer is genuinely interested in the customer’s opinions and is willing to take the time to understand their needs fully. This, in turn, can lead to more honest and accurate feedback, which can be invaluable in the development of new products or services.

The follow-up questions are typically asked via email as opposed to a second interview to avoid customer overwhelm. It is then crucial to rephrase the questions in a way that are clear and concise, while still allowing the customer to provide detailed feedback.

Although not nearly always necessary, the need for clarification and rephrasing of questions after conducting VOC interviews cannot be overstated in those cases where significant discrepancies are detected, or when a breakthrough could emerge as the result of certain customer input.

- Turn the data into the basis for innovative product development: To ensure that customer needs and outcomes are translated into product functionality that the Engineering department can use to develop innovative products, businesses need to use tools such as the House of Quality (HoQ) matrix. This tool, that has endured the test of time, helps businesses to analyze customer feedback and identify the most important features that the product should have to meet customer needs and outcomes. Prioritizing customer needs and outcomes and relating them to specific product features is a key function of the HoQ.

The HoQ helps businesses to relate customer needs and outcomes to specific product features. It uses a diagram that resembles a house, with the customer needs and outcomes represented by the roof, and the product features represented by the foundation. The walls of the house represent the relationships between the customer needs and outcomes, and the product features. This tool also uses scores to indicate the strength of these relationships.

Using tools like HoQ, businesses can provide the basis for a product requirements document that clearly outlines the product features that are necessary to meet customer needs and outcomes. The document should include specific details about the product features, such as their functionality, performance requirements, and any technical specifications that resolve the customers problems. The product requirements document should also prioritize the features based on their importance to meeting customer needs and outcomes.

Bonus – 8) Iterate and improve: The final step is the ongoing VOC process in which you iterate and enhance your product. Once a product has been launched, businesses need to continue to gather feedback from customers and iterate the product based on that feedback. This continuous improvement cycle ensures that the product meets the evolving needs of customers, resulting in increased revenue growth while it makes it tougher for the competition to catch up with your product.

In conclusion, leveraging VOC to develop innovative products is a critical component of driving revenue growth in today’s competitive market. By adopting the seven best practices outlined in this article, businesses can ensure that they are collecting, analyzing, and using customer feedback to develop products that meet the evolving needs of their customers in the most effective way. By doing so, they can stay ahead of the competition and achieve long-term revenue growth. Remember to include the Engineering department in the VOC process. The Engineering department should be involved from the beginning to ensure that they understand directly from the source the customer needs and outcomes that the product should meet.

Unleash Business Growth by Tackling IT Risks

In today’s fast-paced entrepreneurial ecosystem, without proactively addressing IT and #operationalrisks you jeopardize gaining competitive advantage and even worse the ability to grow your business.

How do you avoid this pitfall?

Manage these three areas well and unleash your organization’s full potential and flourish.

– Operational Scalability

– Cybersecurity, and

– Compliance

Below, we’ll delve into actionable tactics for navigating these risk factors, and how tackling them head-on can empower you to grow and maintain a competitive edge.

Operational Scalability: Continuously Enable Business Growth

Operational scalability is essential for enterprises in various industries. However, guaranteeing that your organization can scale effortlessly without confronting barriers calls for a holistic IT strategy that addresses key aspects of growth.

By embracing these fundamental measures, you will empower your business to navigate the complexities of expansion while maintaining efficiency and agility:

Harness Scalable Technologies and Tools

Invest in tools and technologies like Hyperautomation designed to scale your business. Identify systems as likely candidates for cloud solutions to ensure timely, budget minded delivery. By leveraging expandable solutions, you will be equipped to handle growing workloads, preserve your competitive edge, improve your customer experience and foster enduring growth.

Embrace Agile Methodologies

Adopt #agilemethodologies that champion adaptability and flexibility within your organization. Engineering leaders and scrum teams partnered with Business Analysts and Product Owners who understand customer needs and the desired product play critical roles in fostering this approach. This strategy spurs a swift response to change and cultivates a culture of ongoing enhancement, guaranteeing your business remains steadfast in a fast-paced environment.

Continuously Assess Operations with Key Performance Indicators (KPIs)

Use embedded data and analytics to routinely evaluate and scrutinize your operations using KPIs focused on the triple constraints model of time, quality, and budget. Through consistent performance assessment, you can make well-informed decisions and fine-tune processes to fuel success and boost profitability.

Stay Current on Industry Trends and Best Practices

Look for mature SaaS and third-party solutions where this service does not need to provide a competitive advantage for your business. Where you differentiate your business, implement proprietary systems coupled with cutting edge technologies (Robotics/AI) and best practices to establish and retain your competitive advantage. By actively developing and adopting emerging innovations, your business will triumph in a constantly shifting landscape.

Cybersecurity: Safeguard Your Enterprise and Build Credibility

In today’s digital world, #cybersecurityrisk looms large, presenting significant challenges to the continuity of your business operations.

According to a recent survey by Cybersecurity Ventures, the projected annual cost of cybercrime damages is expected to reach a staggering $10.5 trillion by 2025, underscoring the importance of taking proactive measures to address cybersecurity risks and ensure business stability and expansion (Cybersecurity Ventures, 2021).

Additionally, according to the 2022 Cost of a Data Breach Report by IBM, the average total cost of a data breach in companies with public clouds is $5.02 million, with an average time to identify and contain a data breach being 277 days (IBM, 2022).

How can you ensure your business continues safe and sound?

Safeguard your enterprise by adopting a comprehensive cybersecurity strategy that addresses the following critical elements, ensuring a well-rounded defense against potential risks while bolstering your organization’s resilience and credibility:

Conduct Routine Vulnerability and Penetration Assessments

Carry out regular evaluations of your system’s vulnerabilities and potential weaknesses by conducting both vulnerability assessments and internal/external penetration tests. These comprehensive assessments are crucial for identifying weaknesses and maintaining a strong security posture by proactively mitigating risks.

By carrying out routine vulnerability and penetration assessments, you can uncover weaknesses, close security gaps, and make informed decisions to strengthen your overall cybersecurity strategy. Ultimately, these assessments help you to proactively mitigate risks and protect your organization’s assets, reputation, and customer trust.

Implement Strong Access Controls and Network Monitoring

Establish robust access controls and continuously monitor your network to detect and prevent changed and unauthorized access, ensuring the security and integrity of your digital infrastructure. Restrict access on a need-to-know basis only and strongly enforce this philosophy.

Train Employees on Cybersecurity Best Practices

Educate your workforce on cybersecurity threats and best practices, promoting a culture of security awareness. Empowered employees can actively contribute to safeguarding your organization from potential threats. Believe it or not, your employees and their understanding of cybersecurity are the biggest asset and conversely threat to your organization’s security posture.

Develop Backup and Disaster Recovery Plans

Prepare for the unexpected by creating comprehensive backup and disaster recovery strategies. These plans ensure your business can swiftly resume operations following a cyber incident, minimizing downtime and financial losses. You need to know your maximum allowable downtime for each unique system and ensure the ability to restore within those limits.

By developing risk based comprehensive backup and disaster recovery plans considering your maximum allowable downtime and recovery objectives, your organization will be better equipped to resume normal operations quickly and efficiently following a cyber incident or other disruptive events. This preparedness can help minimize the impact on your business, protect your reputation, and reduce financial losses.

Stay Informed About the Latest Cybersecurity Threats

Keep abreast of emerging cybersecurity threats, trends and actors. Cybersecurity is an ever-changing world and staying informed lets you adapt your security measures accordingly, further fortifying your organization against potential risks.

A robust cybersecurity framework not only shields your business assets but also preserves your reputation and customer trust, empowering your company to prosper in a digital era.

Compliance: Drive Integrity and Cultivate Trust

Upholding stringent standards and compliance (regulatory or otherwise) is crucial for operational excellence, cultivating trust, protecting your reputation, and steering clear of hefty financial penalties or loss of revenue.

In addition, embracing a proactive stance of standards and compliance helps ensure that your organization strictly follows pertinent laws and regulations, ultimately safeguarding your company’s integrity and good standing.

To alleviate these risks and promote a well-managed culture, your organization should:

Establish Compliance Programs, Standards, Policies, and Procedures

Develop and implement comprehensive #complianceprograms, policies, and procedures to provide a clear framework for your organization, promoting a risk-based culture of compliance and accountability. Provide your workforce with training in compliance best practices, empowering them with the knowledge to make responsible decisions that adhere to regulatory standards.

Monitor Regulatory Shifts and Engage with Agencies for Guidance

Keep a close eye on regulatory changes and actively engage with relevant agencies for guidance, ensuring your organization stays up-to-date and adapts to any new requirements.

Leverage Key Risk Indicators (KRIs) in Your Compliance Program

Incorporate #KeyRiskIndicators (KRIs) into your compliance program to help identify and manage potential risks, allowing you to take proactive measures to maintain compliance.

Perform Comprehensive Audits of Pertinent Regulations and Controls

Carry out exhaustive audits of relevant regulations and controls to ensure that your business remains compliant with all applicable legal requirements, standards and procedures. Thus reducing the risk of non-compliance consequences.

By actively managing standards and compliance, your organization can avert costly penalties, maintain integrity of processing, sustain customer trust, and operate more efficiently, contributing to overall business success.

Never Let IT Risks Slow Your Business Down: Embrace Growth with Confidence

Navigating the complexities of operational scalability, cybersecurity, and compliance risks can be daunting, but addressing them head-on is the key to enabling your organization’s growth. By actively managing these challenges, you will confidently conquer the intricate IT landscape, paving the way for lasting success and sustainable expansion.

CXO Partners is here to help businesses like yours overcome their most pressing technology hurdles with Interim CIO, CTO, CISO, and CDO Services. By teaming up with seasoned executives, your company can tackle complex IT risks and create a solid technology strategy to propel growth.

Don’t let IT risks hold you back – tackle them head-on and unlock your business’s full potential. Embrace a proactive approach to IT risk management, and watch your company accelerate in an ever-evolving business environment.

Going Global – Not Just for Multinationals

The rise of technology and communication tools have made easier to connect with customers around the world, making our world a smaller place. It is now more important than ever for companies to consider going overseas as part of their growth strategy.

In today’s increasingly interconnected and globalized world, businesses of all types and sizes are looking to expand into new markets as part of their growth strategy. #goingglobal is a critical step for businesses looking to compete in a rapidly evolving and competitive global economy. This paper will explore why going global is important for companies, with a particular focus on small and mid-sized businesses.

The world has become highly interconnected and globalized. As a result, there are numerous opportunities for businesses to expand their operations into new international markets and regions. I know firsthand how impactful going global can be for a business. I helped open four international offices covering the #emea region, and the resulting access to new resources and customers was a major factor in the company’s growth.

But when we got it right, the rewards were huge: eventually, our annual revenue tripled with 60% of it coming from our international operations and customers.

One of the main reasons why going global is important for companies is that it allows them to access #newmarkets and customers. By diversifying their customer base, companies can reduce their reliance on any one market, making them less vulnerable to economic fluctuations and changing consumer preferences. Moreover, expanding into new markets can also help companies to increase their revenue streams and achieve economies of scale, thereby improving their overall profitability.

Another key benefit of going global is that it allows companies to access new talent and resources. When companies expand into new markets, they can tap into local expertise and leverage their knowledge and resources to drive innovation and #growth. This can be especially important for smaller companies that may not have the resources or expertise to compete on a global scale.

Furthermore, going global can also help companies to reduce their operational costs. When companies expand into new regions, they can take advantage of lower costs of production, transportation, and labor. This can help companies to reduce their overhead expenses and increase their profit margins.

For small and mid-sized companies, going global can be a key driver of growth and #profitability, but doing so requires the right strategy and execution. A well-planned and executed going global strategy should cover important aspects such as:

- Market segments and size: Before expanding into a new market, it’s important to identify the target market and assess its size and potential demand. Conducting market research can help businesses understand the needs and preferences of their target audience in key geographies and determine whether there is a viable opportunity for growth in that market.

- Cost of setting up: Entering a new market can be expensive, and businesses need to budget accordingly. Costs can include legal fees, marketing expenses, product localization, and more. Conducting a thorough cost analysis can help businesses determine whether expanding into a new market is financially viable.

- Incorporation and overall organizational structure: Each country has its own rules and regulations for incorporating a business, and it’s important to understand the legal requirements and procedures for doing so. Businesses need to consider factors such as taxation, liability, and intellectual property protection when deciding on the best legal structure for their new operation.

- Talent pool: Accessing a new talent pool can be a significant advantage when expanding into a new market. However, it’s important to understand the local labor market and ensure that the business can attract and retain the right talent. This may involve offering competitive salaries, benefits, and opportunities for career development.

- Languages support: Language barriers can be a significant challenge when entering a new market but hiring local talent should address it. It’s important to consider the language needs of the target geographies and ensure that the business can communicate effectively with local customers and partners through its local operation.

- Ease of travel and logistics: Logistics can be a significant challenge when expanding into a new market, particularly when it comes to shipping products and managing supply chains. Businesses need to consider the ease of travel to the new market based on the products they sell and resources requirements, and identify any logistical challenges that may arise, such as customs regulations, transportation infrastructure, and travel to and from customers sites.

- Partnerships: Alliances and partnerships could help minimize some of the setup cost and give business a quicker access to key markets and accounts. Partnering with local businesses or organizations can be an effective way to enter a new market and build relationships with key stakeholders. Businesses should consider potential partners carefully and seek out those that have a strong reputation and complementary capabilities. Developing strong partnerships can help businesses navigate the local market more effectively and accelerate their growth.

My experience taught me that a strong global strategy is critical for success. As we expanded into new #internationalmarkets, we had to carefully consider factors such as market segments, costs, and partnerships. But when we got it right, the rewards were huge: eventually, our annual revenue tripled with 60% of it coming from our international operations and customers.

Going global is a critical strategy for small and midsized companies looking to drive growth and profitability. By accessing new markets, talent, resources, and cost savings, they can diversify their customer base while increasing their revenue streams and profitability. However, it is important to have a well-planned and executed going global strategy to ensure success in today’s interconnected and competitive global economy.

While expanding globally can be challenging, it is also a necessary step for businesses looking to compete in today’s interconnected and competitive global economy. But this challenge can become an opportunity by leveraging the expertise and resources of executives and senior directors that have done it and can help navigate the complexities of entering new markets and geographies.

CXO Partners is an #interimexecutive management firm with a team of experienced executives and experts with a proven track record of success. They can help businesses navigate the complexities of entering new markets and develop a well-planned and executed global strategy. Please feel free to reach and connect with me to discuss and assess the benefits of going global to your business.